The Internal Revenue Service (IRS) has established many types of tax-favored health plans to assist with paying for medical expenses…including tubal reversal surgery. This wonderful news can be found in IRS Publication 502 under the Fertility Enhancement section. Below is an overview of how these types of plans work to offer you a discount on your tubal reversal surgery as well as help you create your own tubal reversal loan. IMPORTANT: Check with your tax professional before deciding if using a tax-advantaged health plan is right for you.

Cheaper Tubal Reversal

Does your employer’s health insurance plan offer a Flex Spending account (FSA) or Health Savings Account (HSA)? If not, did you know that some banks are set up to be HSA trustees so you can set up an account for yourself? Here is how these types of health-related accounts work:

- You estimate the amount you will spend on eligible medical expenses for the coming year.

- During your healthcare enrollment period, you elect to have the plan take out that amount from your paychecks. The amount per paycheck will be the total amount of your contribution to your FSA or HSA divided by the number of paychecks you receive annually. For example, if you contribute $2,600 for the year and you get paid weekly (52 weeks in a year), then your FSA account contribution per paycheck will be $50 ($2,600 ÷ 52).

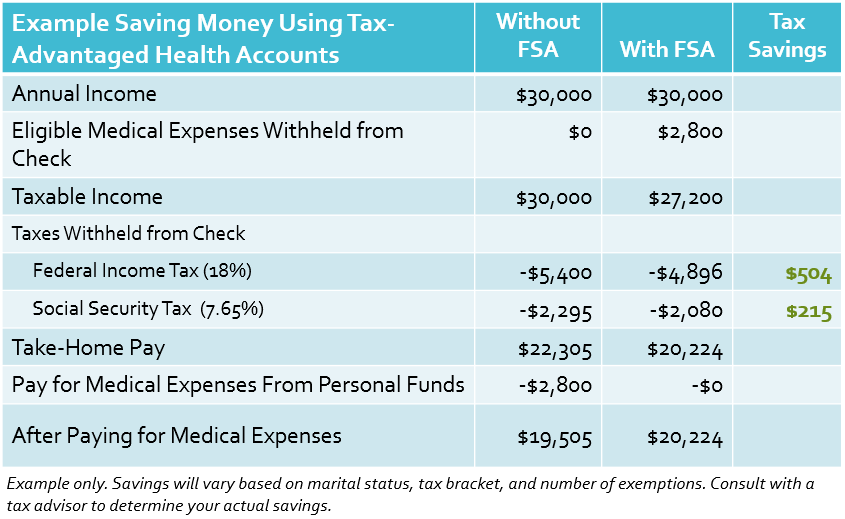

- Your savings will vary depending on your situation, but see an example below of how paying for your tubal reversal from a tax-advantaged health account can make your tubal reversal cheaper.

- It is important to note that you may lose your contributions if you do not use them for medical expenses in the year you contribute to your account so plan carefully.

Give Yourself a Tubal Reversal Loan

Your employer’s Flex Spending Account has another excellent advantage. You can use the account to give yourself a loan with no interest, no credit check, and guaranteed approval. Here is how it works:

- Elect to contribute the desired amount for your medical expenses to your FSA during the enrollment period.

- Schedule your tubal reversal near the beginning of the health plan year.

- Pay your tubal reversal fees to your surgeon, immediately requesting reimbursement from your FSA.

- Your employer must reimburse you for all qualifying expenses.

- You have the rest of the year to repay the loan with pre-tax payroll deductions.

Combine Strategies for Affordable Tubal Reversals

Depending on your personal financial situation, you may have to save for your tubal reversal for a couple of years or more. Here are some ideas for using health-related savings accounts to both save for and save on your reversal surgery:

- Consider finding ways to earn extra cash. Turn your talents that people always tell you that you are good at into a service that pays. Great at wrapping presents? Offer this service to family and friends. Like to sew or crochet? Make gifts for holidays to sell on Facebook Marketplace. There’s no limit here to the ideas you can try to earn money to build your tubal reversal account.

- Determine the amount you can pay back in a year’s time so that you can plan how much your savings account must be before giving yourself a loan using your FSA as explained above. For example, if you can comfortably pay back $2,500 in a year and have access to contribute to an FSA, then save up $4,950 using these ideas. That will make Dr. Rosenfeld and Dr. Dafashy’s tubal reversal fee more affordable, allowing you to have your surgery sooner.

Don’t have access to these types of medical savings plans? Not to worry. Dr. Rosenfeld and Dr. Dafashy offer payment plans that suit your budget. We have no set payment requirements, you pay when you can. The complete fee is due 2 weeks before surgery. Just call our office at 713 790 0099, Monday thru Friday from 9am to 5pm Central. Note: setting up payment arrangements cannot be made over emails or Facebook messages. One of our staff will assist you with setting up payments. We also accept CareCredit. Read more about tubal reversal financing options.